Merkel recently released its Digital Marketing Report for Q4 2019. We have penned down some of the key findings from the report in this post.

The complete report can be downloaded here.

Search Ad Investment Growth Steady through the Final Quarter of 2019

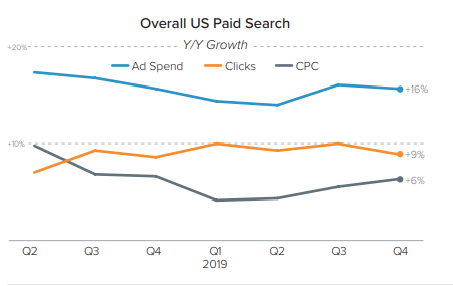

Advertiser spending on paid search ads grew 16% Y/Y in Q4 2019 however, Search ad click growth slowed slightly from Q3 to Q4 2019. Average CPC growth boost to 6% Y/Y as advertisers faced spiking CPCs for Microsoft search ads. Advertisers used Google’s Similar Audience targeting to generate 11% of their Google search ad clicks in Q4 2019.

There have been significant swings in volume growth rate for Google Shopping and text ads but Google Shopping Ads maintained revenue per click advantage over text Ads by 18%in Q 4 2019.

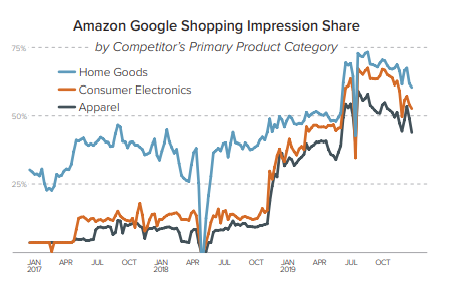

While Amazon’s share of Google Shopping impressions dipped during Cyber Week, Amazon was much more prominent in Google Shopping auctions in Q4 2019. Amazon had pushed spend in the run-up to Prime Day and has been more aggressive since.

Among retailers, Microsoft Product Ads produced 33% of all Microsoft search ad clicks in Q4 2019. With regards to the phone share of Google Search Ads, Google generated 65% of its search ad clicks on phones in Q4 2019. Phone share of Microsoft Search Ad clicks fell five points between Q3 and Q4 2019.

Social media and Google Display Network ad spending growth

Excluding Instagram, spending growth for Facebook ads has been accelerated in Q4 2019. Facebook impression growth has fallen 5% Y/Y, while average CPM rose 20% in Q4 2019, up from a 7% decline in Q3.

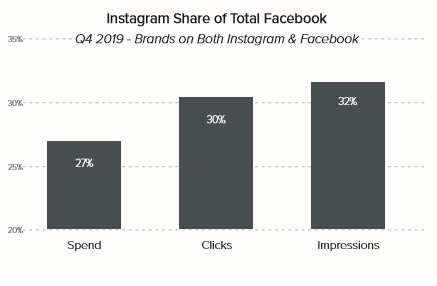

For advertisers running ads on both Instagram and Facebook in Q4 2019, Instagram accounted for 27% of total Facebook ad spend, up from 21% a year earlier. Instagram produced 30% of the total Facebook clicks in Q4 2019 and 32% of impressions.

Mobile devices have played a major role across all social media platforms. Mobile devices accounted for a smaller share of Facebook spend at 89% in Q4 2019, which was up from 86% a year earlier. 96% of Mobile Facebook Spend Going to Reach Facebook App Users.

While a majority of Instagram ad clicks are still generated by Instagram feed ads, Instagram Stories ads are having a significant impact on total Instagram volume. In Q4 2019, Stories ads generated 25% of Instagram ad clicks and accounted for 21% of total spending, among brands using the format

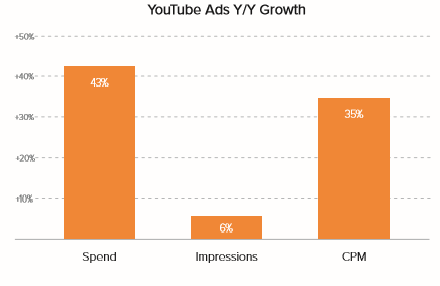

YouTube ads continued to outpace that for Google search ads in Q4 2019, with advertisers increasing their YouTube investment by 43% Y/Y. Among brands running both Google search ads and YouTube ads in Q4 2019, YouTube accounted for 26% as much spend as Google search ads.

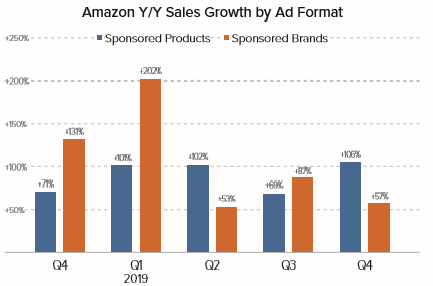

Acceleration of Sponsored Products ads across Amazon’s Sponsored Ads formats

Spending growth for Amazon Sponsored Products ads accelerated to 63% Y/Y in Q4 2019, up from 35% growth in Q3. Click growth accelerated to 42% Y/Y, while CPC growth increased to 15% Y/Y which is 21% higher after a year of declines.

Sales produced by Sponsored Brands ads rose by 57% Y/Y in Q4 2019, which more narrowly exceeded spending growth for the format, but advertiser ROI still improved.

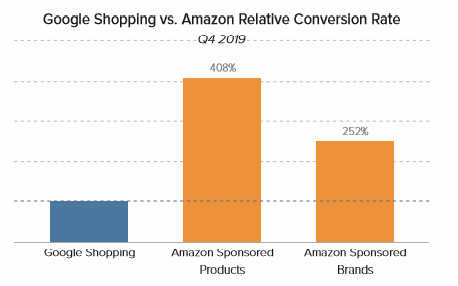

Compared to advertisers running Google Shopping ads in Q4 2019, those running Amazon Sponsored Products ads saw Sponsored Products produce conversion rates that were four times that of Google’s ads. The average sales per click for Sponsored Brands was 19% lower than Sponsored Products in Q4 2019.

Similar to Sponsored Products, Sponsored Brands ads saw top-of-search placements generate a larger share of their sales in Q4 2019. Nearly 93% of Sponsored Brands Spend went to top-of-search placements in Q4 2019.

Once again, here is the link to download the report and access the findings.

Related Links

Stop the wasted ad spend. Get more conversions from the same ad budget.

Our customers save over $16 Million per year on Google and Amazon Ads.