Is Google squeezing every penny out of advertisers? These slides dive into accusations that Google manipulates search ad auctions, potentially leading to higher advertising costs for everyone, and impacting competition and user experience in online advertising.

This post summarizes excerpts from a recent lawsuit filed by the US Department of Justice (DOJ) and several states against Google. The lawsuit focuses on Google’s practices within search ad auctions, a key area of their advertising business.

In this post, we share some of the allegations of how Google, as a dominant player in the online advertising market, might be manipulating these auctions to potentially raise prices for advertisers.

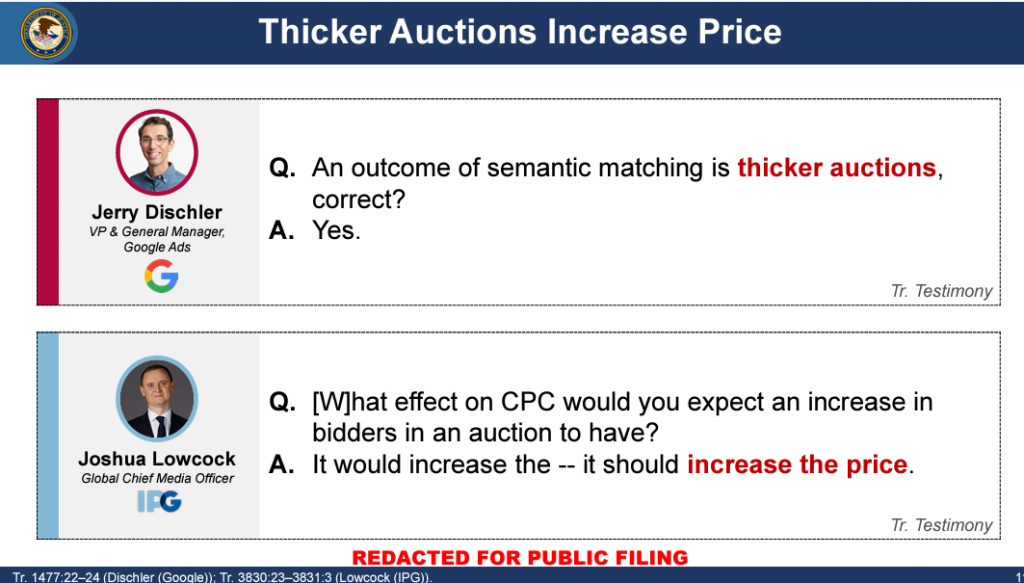

Google’s Match-Type Expansions and Increased Advertising Costs

Google’s implementation of “match-type expansions” in search advertising has led to higher prices for advertisers. The key points are:

- Match-Type Expansions: Google automatically expands the reach of advertiser keywords, potentially showing ads for searches with broader meanings than intended.

- Thicker Auctions: This increased reach leads to more advertisers competing in each auction for ad placement, making the auctions “thicker.”

- Higher Prices: With more competition, the cost per click (CPC) for advertisers is expected to rise. Experts and internal Google documents are cited to support this claim.

- No Opt-Out: Advertisers cannot opt out of match-type expansions, leaving them with limited control over their ad placement.

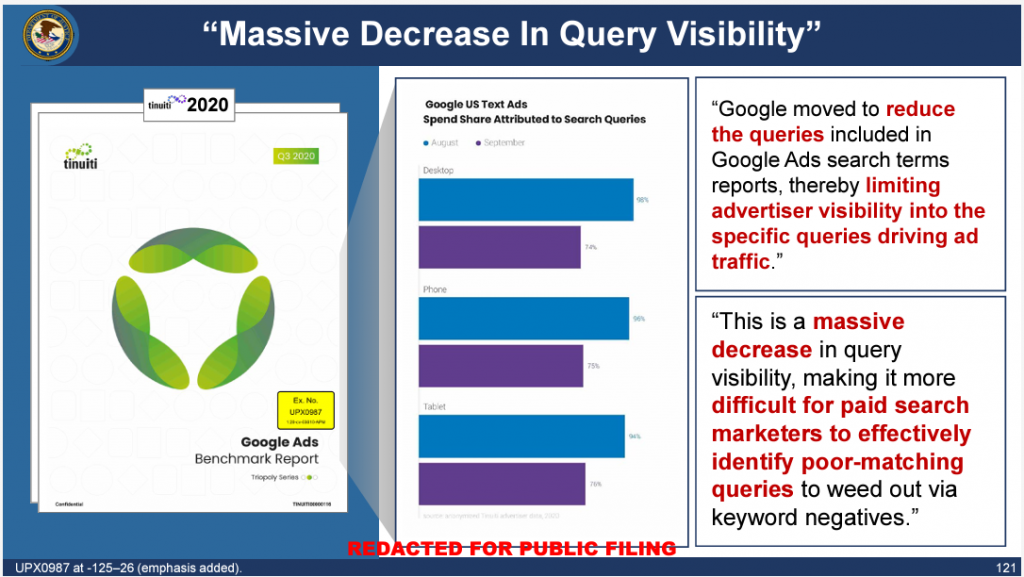

Google Limits Advertiser Visibility into Search Queries

Google Ads has reduced the number of search queries advertisers can see in their reports. This lack of transparency makes it harder for advertisers to manage their campaigns effectively.

Here are the key points:

- Reduced Query Visibility: Google has limited the number of queries shown in search term reports, making it difficult for advertisers to see which specific searches triggered their ads.

- Impact on Advertisers: This reduces advertisers’ ability to identify and exclude irrelevant searches (negative keywords) that might not be converting well. Essentially, advertisers are “buying” clicks without knowing exactly what triggered them.

- Privacy Concerns as a Pretext: Google’s explanation of privacy concerns is a weak excuse. Anonymized and aggregated query data has been available before, and there seems to be no new privacy risk.

- Analogy: It compares the situation to buying a product in a supermarket without knowing what it is, highlighting the lack of information advertisers have about where their ad spend is going.

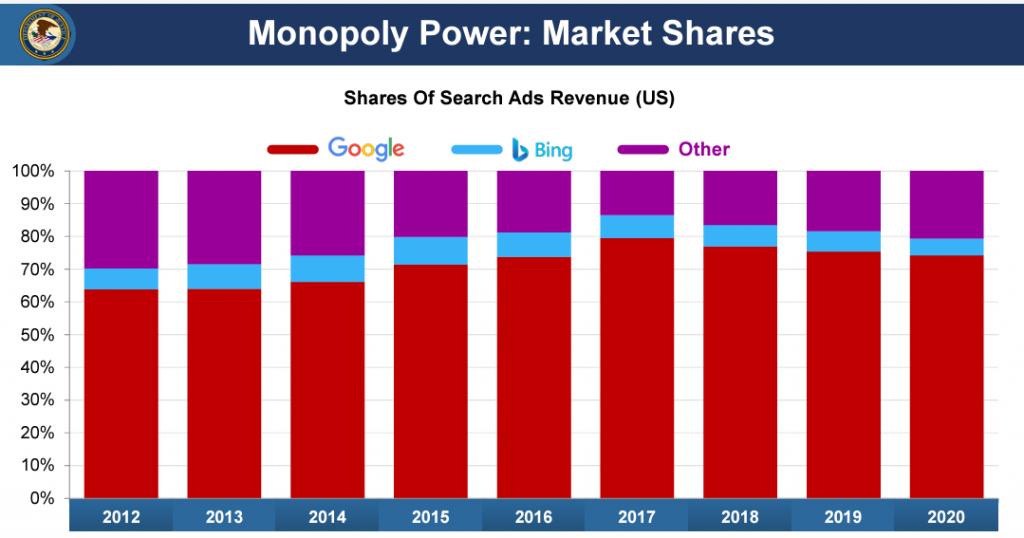

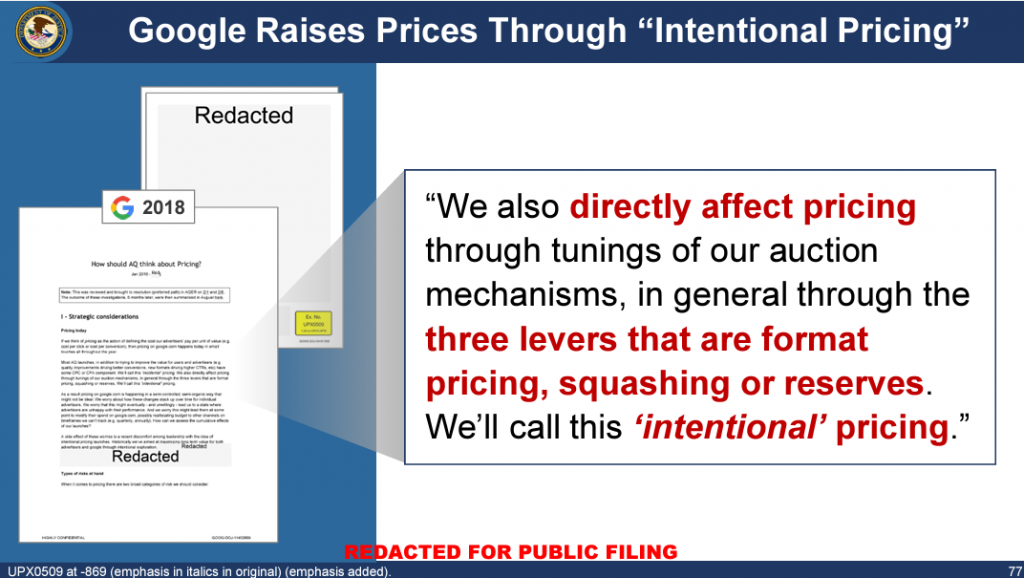

Google’s Monopoly & Potential Manipulation of Search Ad Prices

- Google’s Control Mechanisms: Google admits to having “knobs and tunings” that can impact pricing, suggesting they can adjust algorithms to raise prices.

- Redefining “Fair Prices” as Higher Prices: Google seems to define “fairer” prices as simply higher prices, potentially benefiting Google at the expense of advertisers.

- Internal Revenue Focus: An internal Google communication refers to a “code yellow” for search revenue, suggesting a focus on increasing revenue even if it means raising prices.

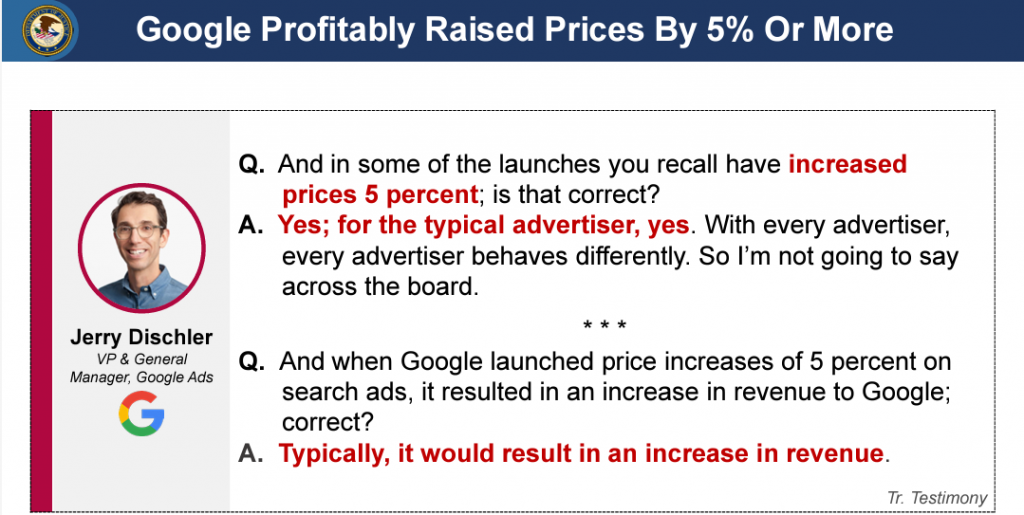

- Profitable Price Increases: Google executives acknowledge that price increases have led to higher revenue for Google, even at increases of 10-15%.

- Historical Price Increases: Data shows that Google search ad prices have indeed increased significantly over the past decade.

- High Profitability: Google’s search advertising business is portrayed as incredibly profitable, suggesting they have room to adjust prices without significantly impacting their bottom line.

- Ignoring Economic Laws: Google itself acknowledges that its search advertising model allows them to “ignore fundamental laws of economics” regarding supply and demand, potentially by raising prices without losing customers due to their dominant position.

- Focus on Revenue Growth: Evidence suggests Google prioritizes consistent revenue growth (around 20% year-over-year) and has used various tactics to achieve these targets, potentially including price hikes.

Not Considering Competitor Prices When Setting Ad Rates

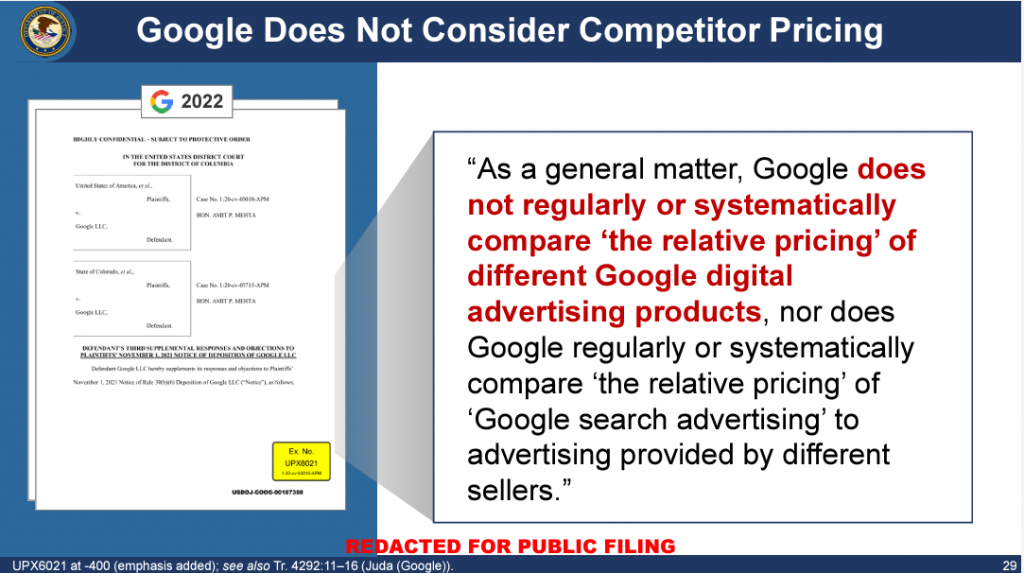

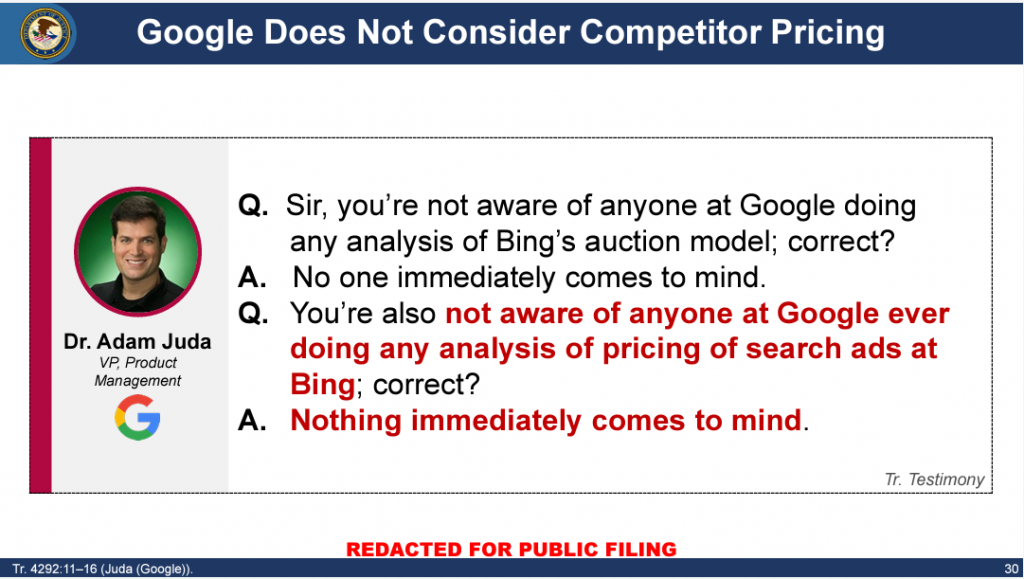

Google, in its dominant market position, might not be setting ad prices based on competition. Here are the key points:

- Google’s Approach: Google admits it doesn’t regularly compare its own ad products’ pricing or its search advertising prices to those offered by competitors like Bing or Facebook.

- No Market Pressure to Change: Google suggests they haven’t felt market pressure to adjust their advertising practices, potentially due to their strong position.

- Justification: Google claims it wouldn’t know how to reliably factor competitor costs into their auction system, even if they wanted to.

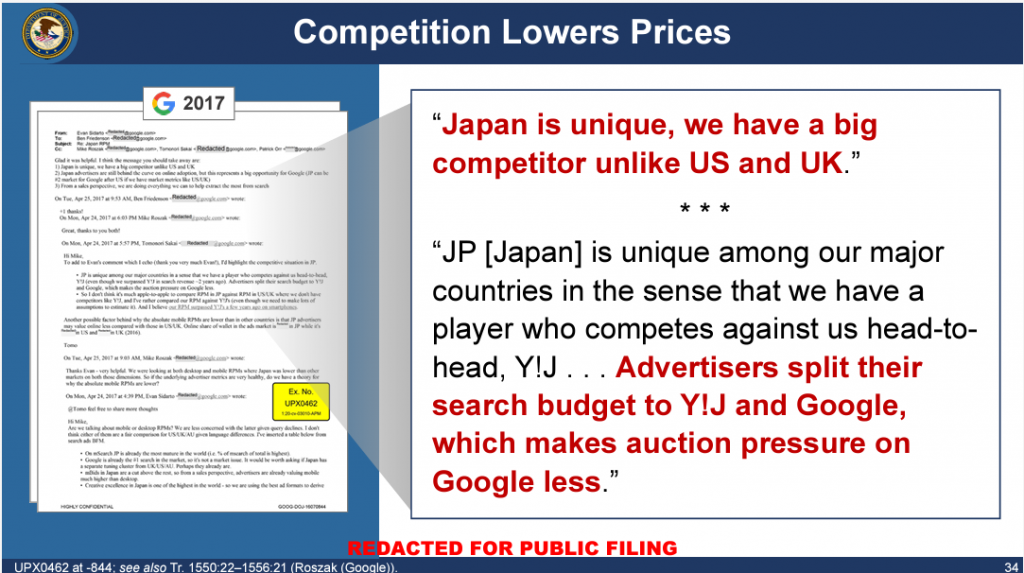

- Exception: Japan: The passage mentions Japan as a unique case where Google has a strong competitor (Yahoo! Japan), leading to “auction pressure” and potentially lower prices in that market.

Google’s Alleged Manipulation of Ad Auctions and Potential Harm to Advertisers

These slides argue that Google manipulates search ad auctions in ways that harm advertisers. Here are the key points:

- Monopoly Power: The passage starts with a legal concept of monopoly power, where a firm can raise prices without considering competition.

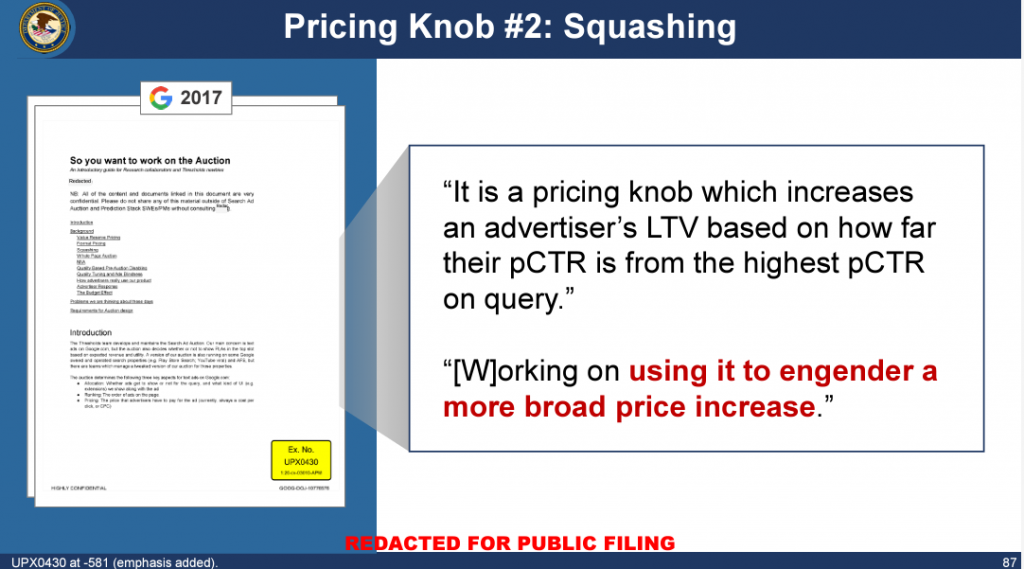

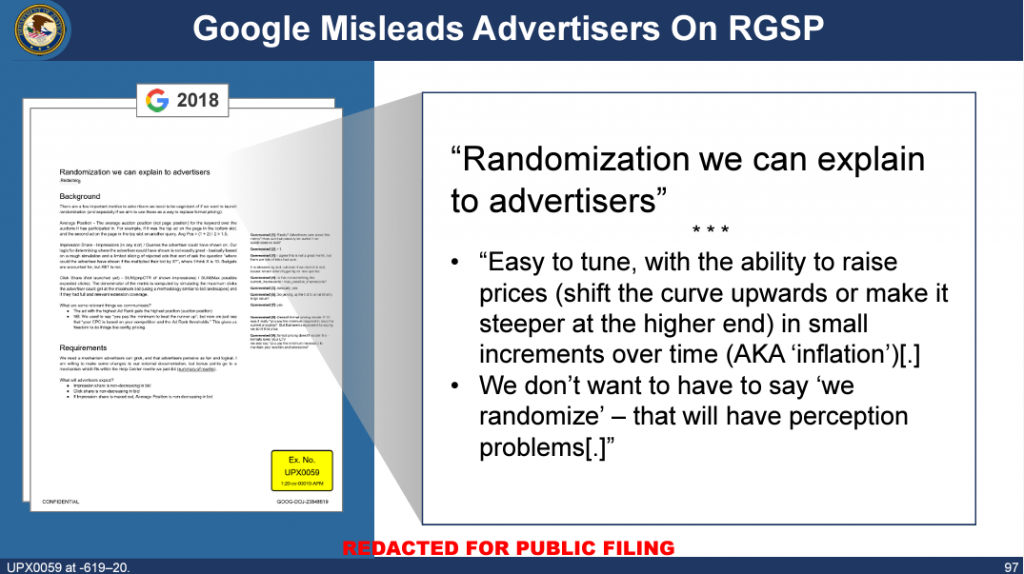

- Google’s Pricing Knobs: Google admits to having various “knobs” to influence auction pricing, including format pricing, squashing, and a system called “randomized GSP” (rGSP).

- Intentional Price Increases: Google documents show discussions about using these knobs for “intentional pricing” and potentially large price increases.

- Format Pricing: This method is described as an effective way to raise prices for advertisers, with one internal document calling it the “best knob to engender large price increases.”

- Squashing: This increases the price paid by the highest bidder in an auction, potentially to recover revenue lost from other changes.

- rGSP: This system introduces an element of randomization into the ad auction, potentially allowing Google to raise prices further while making it harder for advertisers to predict costs.

- Lack of Transparency: Google has not openly communicated changes like rGSP to advertisers, and advertisers cannot opt out of it.

- Harm to Advertisers: These practices allegedly lead to higher prices for advertisers, potentially with reduced quality or a negative user experience. Google is accused of prioritizing revenue over efficiency and advertiser best interests.

To view all the slides click here

Related Links:

Stop the wasted ad spend. Get more conversions from the same ad budget.

Our customers save over $16 Million per year on Google and Amazon Ads.