The Digital Marketing Report by Q3 shares some great insights on organic search, display advertising, impact of ad blocking in iOS 9, mobile traffic, evaluate performance of Yahoo Gemini. You can view the entire report by downloading it here.

Here are the key highlights of the Q3 report:

1. The surge in mobile traffic

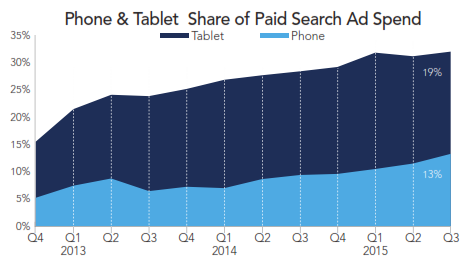

Google’s decision to include three search ads above the organic search results, has greatly impacted the mobile traffic performance in Q3. Phones contributed with 27% of search clicks in Q3, which is a straight 20% hike from the last year. While the tablet click share fell to 16%, both these devices contributed in a total of 32% of paid search spend in Q3.

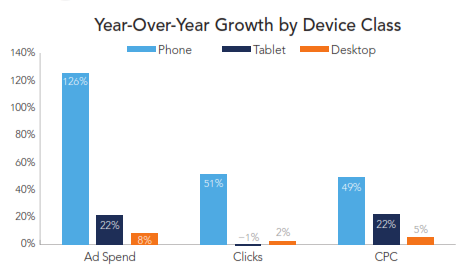

Individually the break up of the search spend across device showed that total spend on phone rose 126%, which was 80% higher than the previous quarter.

2. Impact of Ad Blocking in iOS9 on paid search

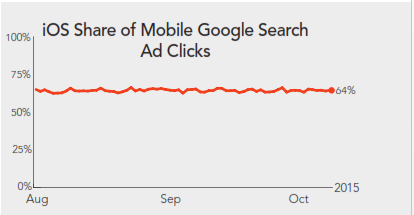

Amidst speculations that the launch of iOS9 would affect traffic tremendously, there hasn’t been yet any discernible impact to the trafiic via iOS. The newly launched iOS9 supports new ad blocking tools that would blocks ads on Safari browser on iPhones and iPads. However since its launch on 16th September the impact is minimal, but is surely a thing to watch out for.

3. Paid search overall performance

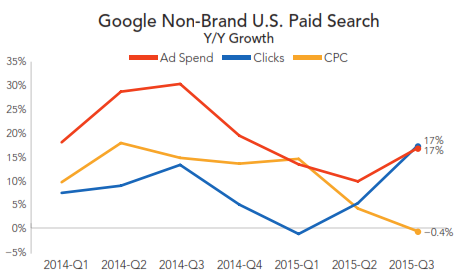

The spending on paid search ads saw an increase of 19% YoY in Q3. Non-brand ad click saw a growth of 17% from previous quarter’s 6%, as a result of Google’s decision to show more text ads on phones.

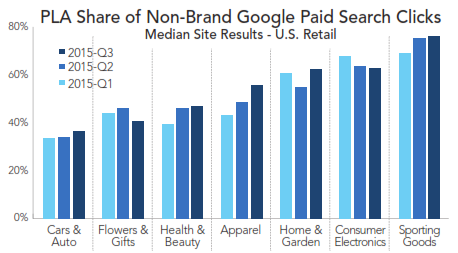

The text search ad clicks grew by 1% after witnessing a 5% decline in Q2. Clicks on product ads from Google and Bing grew by 47%. Industry study shows that Apparel sector continues to see more results through the PLAs in paid search advertising.

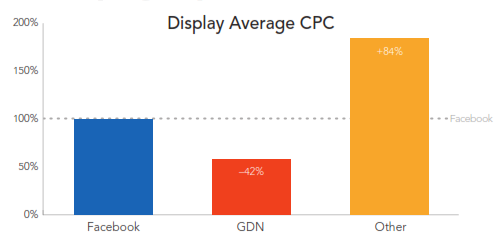

4. Google’s display network against other display advertising options

While advertisers use GDN for their remarketing strategies, Facebook ads were used most likely to find new prospects. This shows in the data, which suggests that GDN conversion rate was 42% higher than that of Facebook ads. Though GDN CPC were 42% cheaper than Facebook but Facebook in comparison to other social giants was 82% more cheaper

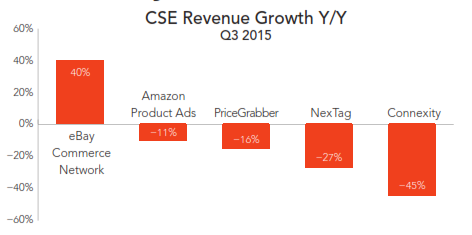

5. Revenue from Common Search Engines.

Revenues generated form common shopping engines witnessed a major downfall, with only eBay’s gaining revenue at 40% and Amazon Product Ads declined by 11% in Q3. Amazon’s Product Ads CPC is observed to be 9% more expensive than Google PLA as seen in Q3 report. While Amazon Product Ads showed major rise in CPC, all other major CSEs saw a decline in it. eBay tops the CSEs in ad spend, with a 41% share and Amazon spend share increased to 16%.

To view the entire report and its findings click here

Related Articles:

- The Cost of Ad Blocking – PageFair and Adobe 2015 Report

- Merkel|RKG Digital Marketing Report (Q2 2015) – Highlights

- Merkel|RKG Digital Marketing Report (Q1 2015) – Highlights

Stop the wasted ad spend. Get more conversions from the same ad budget.

Our customers save over $16 Million per year on Google and Amazon Ads.