The Q1 2023 Digital Ads Benchmark Report by Tinuiti, a digital marketing agency in the United States, provides insights into quarterly trends for Google, Meta, Amazon, and other platforms. The report is based on anonymized performance data from advertising programs managed by Tinuiti, and highlights several key findings, which are outlined below.

The complete report can be downloaded here.

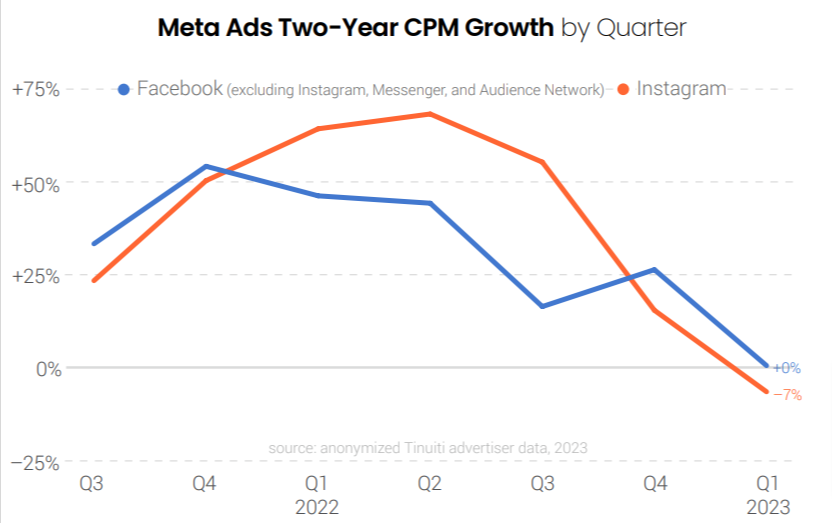

Facebook CPM remained stable while Instagram CPM dropped by 7%

The CPM on Facebook during Q1 2023 remained the same as what was seen during Q1 2021. Meanwhile, the CPM for Instagram was 7% lower compared to the same quarter two years ago. In Q4 2022, CPMs on both Facebook and Instagram declined meaningfully.

In Q4, advertisers reduced their spending on Instagram by 3% compared to the previous year, but there was a rebound in Q1 with a 15% increase in spending. Additionally, the CPM on Instagram decreased for the second consecutive quarter, dropping by 21% year over year, following a decline of 16% in Q4.

Instagram reels have lately become quite popular. During Q1 2023, Reels ads made up 10.8% of the total ad impressions on Instagram, which is more than four times the 2.5% impression share recorded in Q1 2022. Furthermore, this represents an increase from 8.3% in Q4 2022.

For the median advertiser during the first quarter, the CPM of Instagram Reels ads was 47% lower compared to that of Instagram Feed placements. Additionally, the CPC was 19% lower for Reels ads as well.

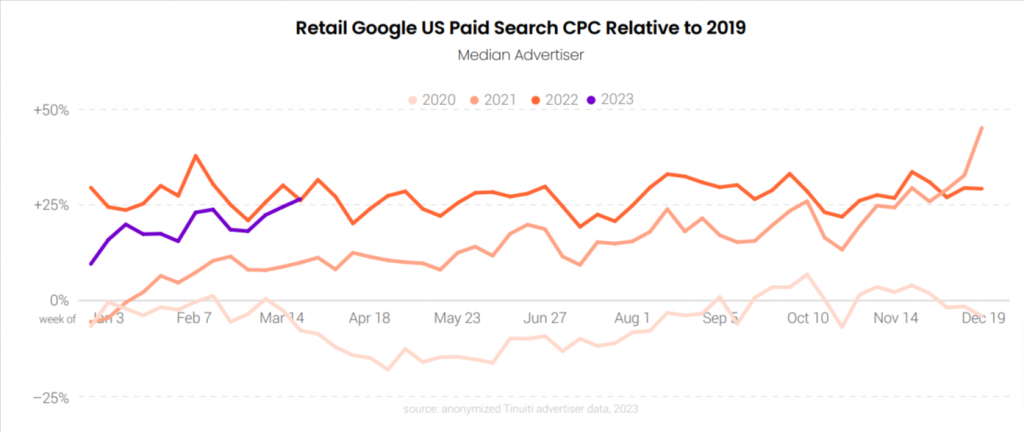

Google search ad & Retail Google search CPCs noticed slow growth

Google search ad CPC growth slowed for the seventh quarter in a row. It fell 1% Y/Y in Q1 2023, the first decline advertisers have seen since Q3 2020. After a weak start to the year, retail CPC growth picked up. Weekly retail Google search CPCs increased by an average of 20% compared to the levels seen in 2019. This is a decline from the average growth of 27% observed in the previous year.

In generating Google search ad clicks, Similar audiences played a significant role, but their share has declined by around two points after Google’s announcement in November 2022 that it would sunset this segment, starting from May 2023.

During Q1 2023, spending on Google search text ads increased by 9% compared to the previous year. Advertisers also saw a 7% growth in text ad clicks during the quarter, which was the most substantial increase since Q1 2021. However, text ad pricing growth remained weak, with CPCs rising by only 2% year over year in Q1 2023. After reaching its peak at 37% year over year in Q1 2021, text ad CPC growth has continued to decelerate for seven consecutive quarters.

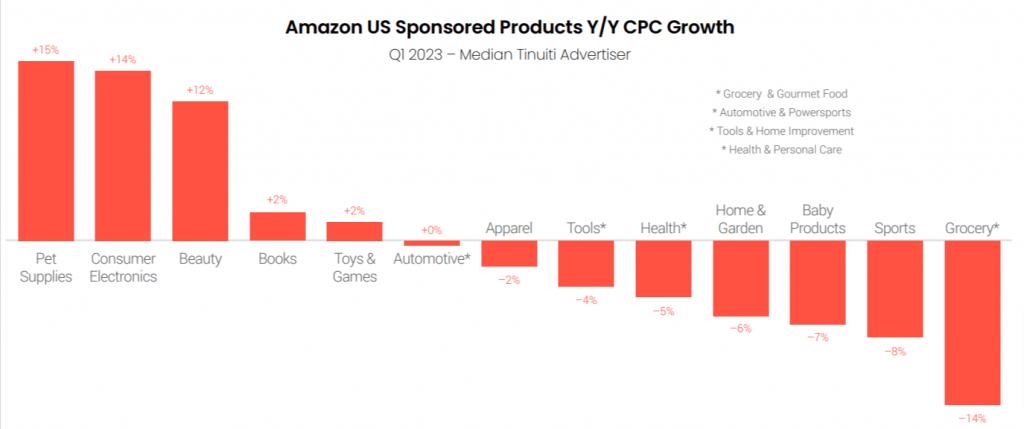

Sponsored Brands and Sponsored Products CPC growth grew softer

The CPC growth of Sponsored Products advertising option bounced back from a 14% drop in December to just a 1% decrease in January, while Sponsored Brands CPC growth also improved from a 4% decline in December 2022 to a 3% decrease in January 2023. However, towards the end of the quarter, the growth in CPC for both formats slowed down. In the month of March, CPC was down 4% Y/Y for Sponsored Products and 13% for Sponsored Brands.

With regard to the sponsored product categories, CPC grew for five product categories, with pet supplies leading the pack at 15% growth.

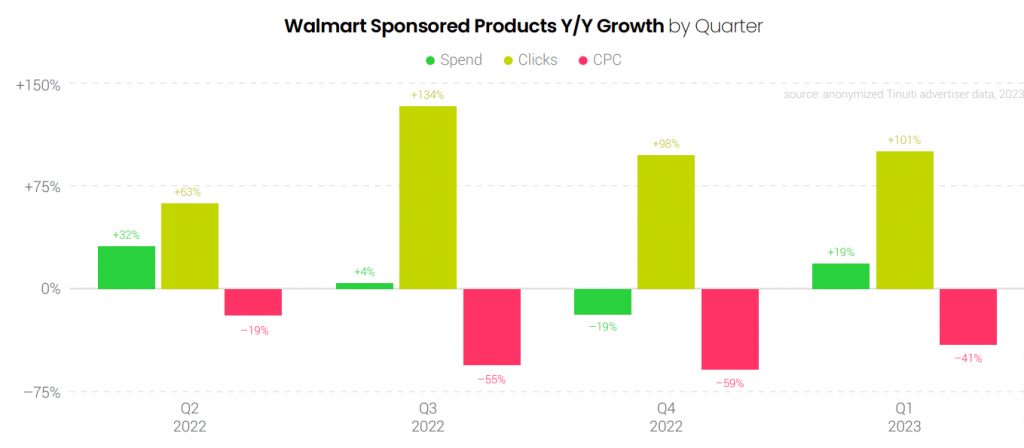

On the other hand, click volume and ROAS for sponsored products continue to soar. Sponsored Product clicks were more than doubled in Q1 as spend grew 19%.

Once again, Sponsored Brands accounted for 11% of all Walmart search ad spend in Q1. Sponsored Products continue to account for the lion’s share of Walmart’s search advertising investment with 89% of total spend.

Average YouTube CPM was down 24% while ad spending growth accelerates

In Q1 2023, spending on YouTube increased by 8% compared to the same period in the previous year. However, the YouTube CPM experienced a decrease of 24% Y/Y in Q1. Despite this, impressions on the platform grew by 42% Y/Y in Q1 2023, which is an improvement from the 33% growth observed in Q4 2022.

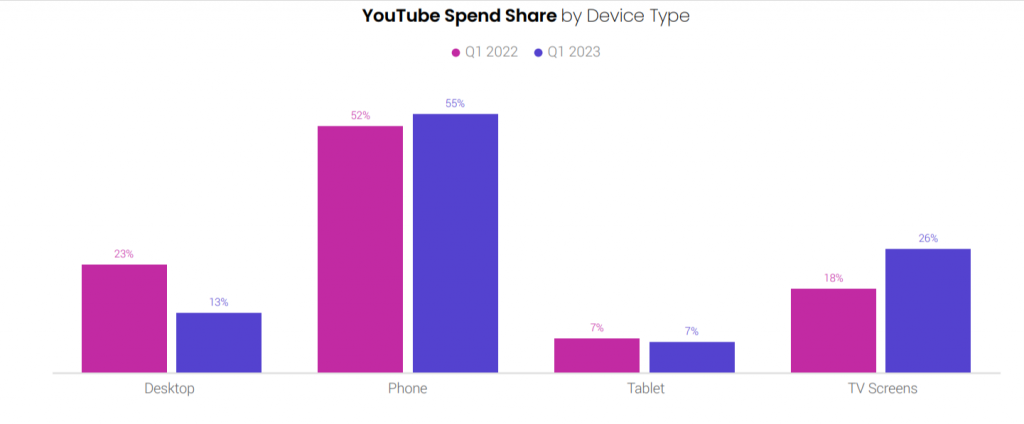

YouTube spend share on TV accounted for 26% of YouTube ad spending in Q1 2023. Phone share of YouTube spend picked up modestly between 2022 and 2023 as phone spending grew nearly 13%.

Google Discovery advertisers increased their investments by 15% in Q1 2023. Similarly, Amazon DSP investments also grew 27% Y/Y in Q1 2023 as impression growth accelerated from 16% Y/Y to 23%.

To get the complete Digital Ads Benchmark Report, download the report here.

Related Links

Stop the wasted ad spend. Get more conversions from the same ad budget.

Our customers save over $16 Million per year on Google and Amazon Ads.