The digital advertising landscape has seen significant shifts over the last few years, with changes in consumer behavior, economic conditions, and competition driving fluctuations in Cost-Per-Click (CPC) across Google Paid Search, Google Shopping Ads, and Google Text Ads. Drawing on data from Tinuiti reports, this post explores the trends in CPC from the first quarter of 2020 to the second quarter of 2024.

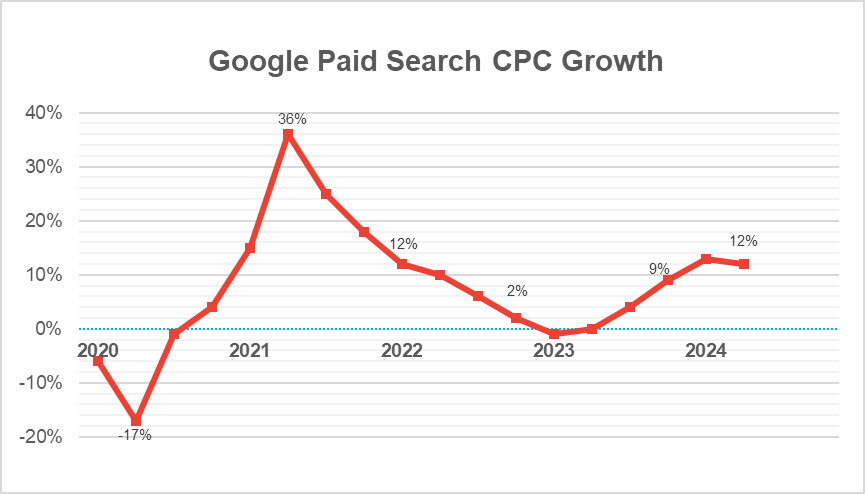

Google Paid Search CPC Trends (2020-2024)

Google Paid Search CPC experienced considerable volatility during the period from 2020 Q1 to 2024 Q2. Here’s a breakdown of the key trends:

- Early 2020 Decline: The CPC saw a sharp decline in Q2 2020 due to the global impact of the COVID-19 pandemic. Many advertisers reduced their budgets or paused campaigns entirely as uncertainty and economic slowdown affected consumer behavior.

- E-Commerce Surge: As the pandemic progressed, there was a surge in e-commerce activity, especially from Q3 2020 onwards, driving up competition and CPCs as more businesses shifted online to capture increased digital consumer spending.

- Strong Recovery in 2021: CPCs surged throughout 2021, with the most significant growth in Q2 (+36%) as the economy recovered and businesses ramped up advertising efforts.

- Mild Fluctuations in 2023: The first half of 2023 showed negligible growth, with Q1 (-1%) and Q2 (0%), indicating a plateau in CPCs. A slight recovery was observed in the latter half, with Q3 (+4%) and Q4 (+9%) showing modest increases.

- Renewed Growth in 2024: 2024 saw a resurgence in CPC growth, with significant increases in Q1 (+13%) and Q2 (+12%), suggesting a revival in advertiser competition and spending.

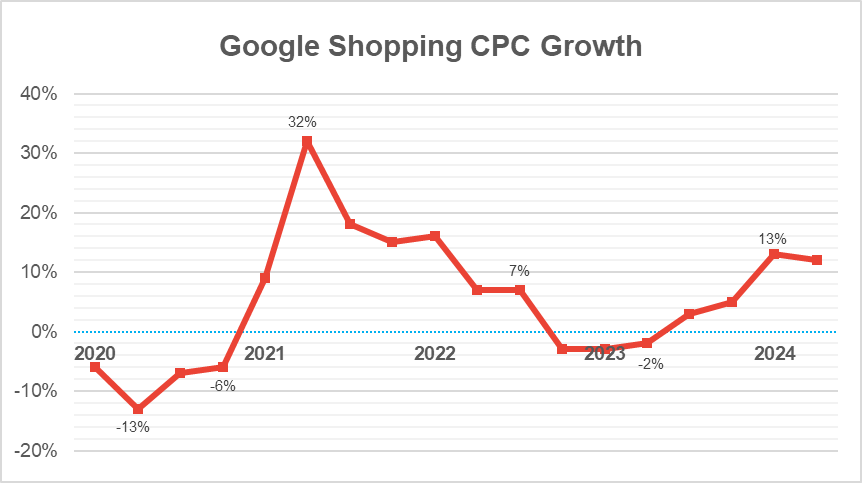

Google Shopping Ads CPC Trends (2020-2024)

Google Shopping Ads followed a similar pattern but with unique characteristics:

- Seasonality and Retail Dynamics in the Last Two Quarters of Each Year: Shopping Ads are heavily influenced by retail cycles, including major shopping events like Black Friday, Cyber Monday, and holiday seasons. These periods typically see higher competition among retailers, leading to increased CPCs. The fluctuations in CPC for Shopping Ads are more pronounced during these peak seasons as advertisers vie for consumer attention.

- E-commerce Growth: The significant rise in e-commerce, especially post-2020, has led to increased investment in Shopping Ads. This trend has been particularly strong as more consumers shift to online shopping, which is reflected in the sustained and sometimes sharp increases in CPC for Shopping Ads.

- Expansion of Local Inventory Ads (2021): Google expanded the availability and features of Local Inventory Ads (LIA), which showcase local store availability. This expansion increased the competitiveness of Shopping Ads as more advertisers leveraged LIAs, particularly in Q4 of 2021, leading to higher CPCs.

- Shift to Privacy-Centric Advertising (2021-2022): With the introduction of privacy changes like Apple’s iOS 14 update and the phasing out of third-party cookies, Google emphasized first-party data and automated bidding strategies. Shopping Ads were affected as advertisers adjusted their strategies, potentially causing shifts in CPC.

- Shopping Ads Placement Changes (2022): In 2022, Google made adjustments to how Shopping Ads were displayed, including more prominent placements in search results and on YouTube. These changes likely increased visibility and competition for prime spots, pushing CPCs higher.

- Advanced Bidding Strategies and AI Integration (2023-2024): Google continued to refine its AI-driven bidding strategies, allowing advertisers to better target high-intent shoppers. These advanced strategies increased competition for top placements, further impacting CPC growth in Shopping Ads.

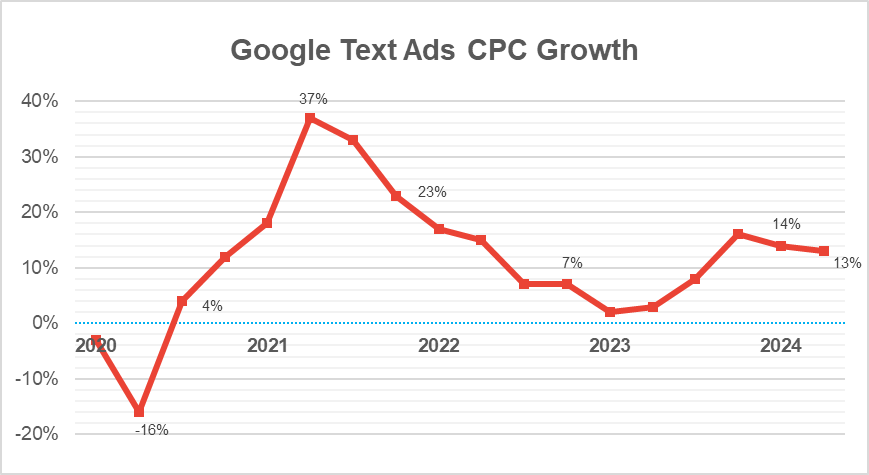

Google Text Ads CPC Trends (2020-2024)

Google Text Ads exhibited the most dramatic shifts:

- Responsive Search Ads (RSA) as Default Ad Type (February 2021): Google made Responsive Search Ads the default ad type, phasing out Expanded Text Ads. This change meant advertisers had to adapt to a new ad format that uses machine learning to optimize ad performance. As advertisers adjusted their strategies, competition for effective ad placements likely drove up CPC.

- Introduction of Broad Match Modifier (BMM) Changes (February 2021): Google announced it would phase out Broad Match Modifiers and incorporate their behavior into phrase match. This update impacted how keywords were matched with search queries, affecting competition for specific keywords and influencing CPC fluctuations as advertisers adjusted their keyword strategies.

- Shift to Automated Bidding Strategies (2020-2022): Over these years, Google increasingly promoted automated bidding strategies like Target CPA, Target ROAS, and Maximize Conversions. These AI-driven strategies made bidding more competitive as advertisers relied on automation to win auctions, leading to shifts in CPC.

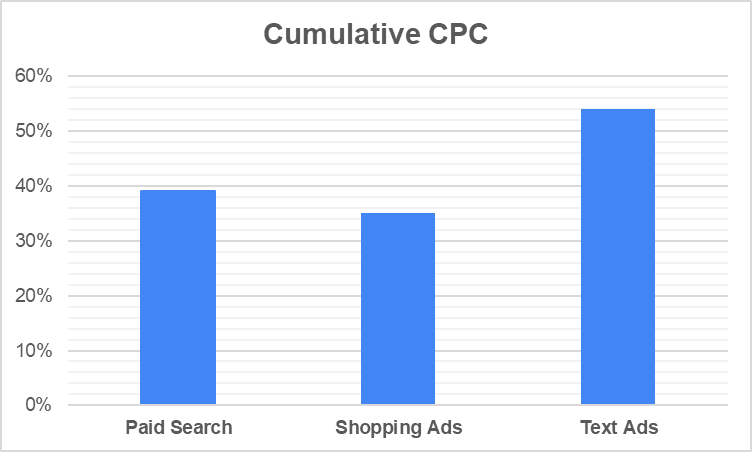

Cumulative CPC Growth from 2020 to Q2 2024

Between Q1 2020 and Q2 2024, Google Paid Search CPC experienced a cumulative growth of 39%, reflecting notable fluctuations driven by various market dynamics. Starting from a base CPC of $1.00 (assumption) in early 2020, there were significant shifts, particularly during the pandemic. CPCs initially declined due to reduced ad budgets, falling by 17% in Q2 2020, before gradually recovering as businesses adjusted to changing consumer behavior.

By Q2 2024, the CPC reached $1.39, with the increase driven by key factors such as e-commerce growth, increased competition, and the adoption of more sophisticated bidding strategies. This 39% cumulative growth underscores the evolving nature of digital advertising and the competitive landscape in paid search over this period.

Conclusion:

From 2020 to 2024, the landscape of Google Paid Search, Shopping Ads, and Text Ads has undergone substantial transformations driven by shifts in consumer behavior, economic recovery, privacy regulations, and Google’s continuous integration of AI and automation.

- For Paid Search, the recovery from pandemic-induced declines was rapid, but stabilization in 2023 signaled a plateau, followed by renewed growth in 2024 as competition ramped up.

- Shopping Ads closely tracked e-commerce trends, with significant CPC growth during peak retail seasons and increasing investment from retailers. Key developments, like the expansion of Local Inventory Ads and privacy-centric shifts, also contributed to fluctuations.

- Text Ads experienced the most volatility, with new ad formats and automated bidding strategies fundamentally changing how advertisers competed for placements.

Overall Trends:

- The data highlights the volatile nature of CPCs, with significant fluctuations due to external factors like the pandemic.

- 2021 was a year of strong recovery, while 2022 and 2023 saw a stabilization and moderate growth.

- The resurgence in 2024 points to renewed confidence and competition in the paid search market.

Looking ahead, as privacy measures continue to evolve and AI-driven bidding becomes more sophisticated, CPCs are likely to remain competitive across all ad formats. Advertisers will need to stay agile, optimizing campaigns to navigate this dynamic environment.

Stop the wasted ad spend. Get more conversions from the same ad budget.

Our customers save over $16 Million per year on Google and Amazon Ads.