The Amazon Ads Benchmark Report for Q3, 2022 was shared by Tinuiti, a US-based digital marketing firm. Based on anonymized performance information from Amazon projects managed by Tinuiti, some of the study’s key findings are documented below.

The complete report can be downloaded here.

CPC For Sponsored Brands & Products Grew By 4% & 5% Respectively

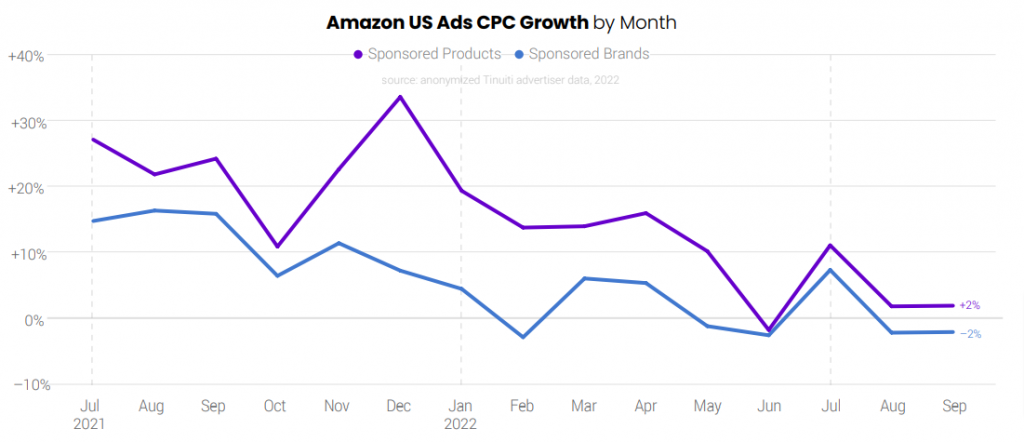

After CPC for Sponsored Products and Sponsored Brands decreased year over year in June, Prime Day sparked an 11% increase in CPC growth for Sponsored Products and a 7% increase for Sponsored Brands in July.

However, the rate of CPC growth swiftly subsided, with Sponsored Brands CPC declining 2% in both August and September and Sponsored Products CPC rising just 2% in both months.

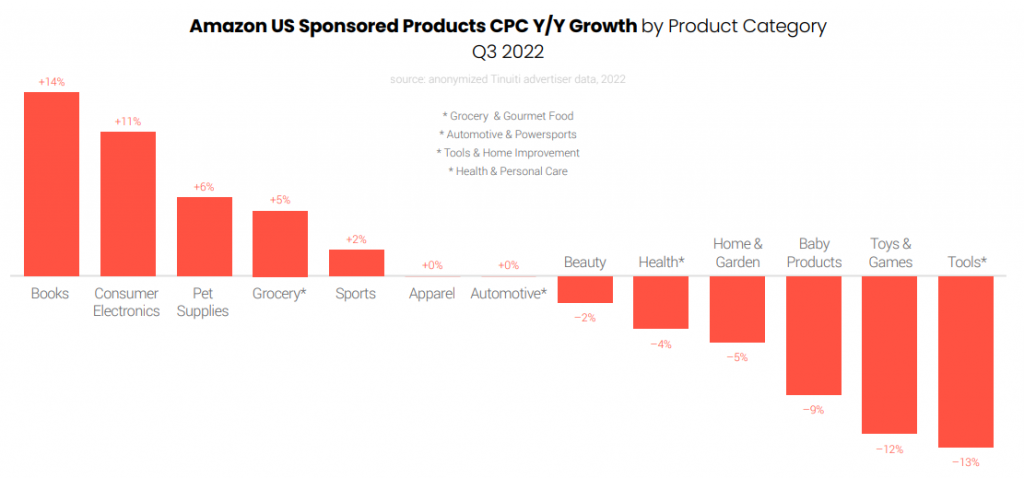

Six out of thirteen major product categories studied for this report showed Y/Y declines in Sponsored Products CPC in Q3 2022, while two categories saw CPC remain the same year over year.

Sponsored Display spend growth slowed in Q3 2022, but spend still rose 11% year over year with a 3% increase in clicks and an 8% increase in CPC. Sponsored Products continue to receive the great majority of Amazon Ad Console ad spend, with a share of 77% in Q3.

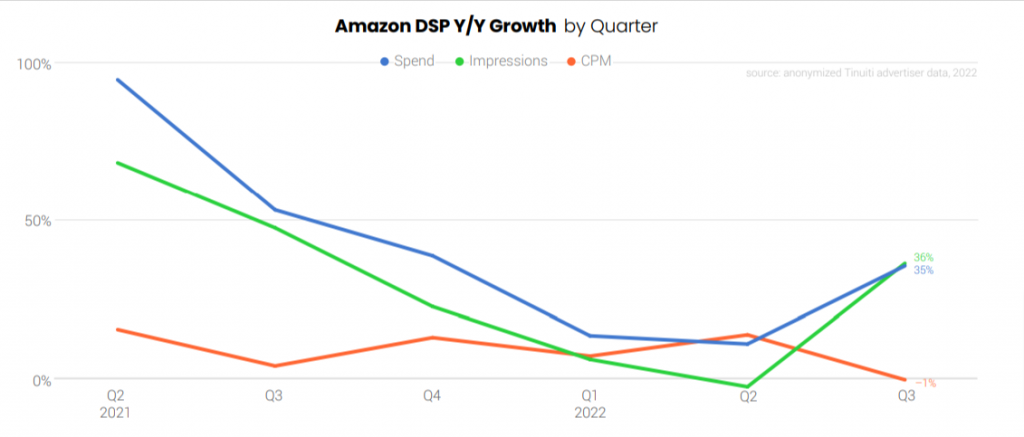

Amazon DSP Spend Grew To 35% In Q3 With Extra Prime Day Investment

With marketers investing extensively in display inventory to assist boost Prime Day outcomes and retarget customers after the event, investment in the Amazon DSP increased 35% year over year in Q3, more than three times as quickly as it did in Q2. The DSP will be a crucial part of Amazon’s advertiser strategy this Q4.

In Q3 2022, 46% of impressions came from sites that are owned and controlled by Amazon, including the main Amazon website and app as well as additional websites like IMDb. 14% of the money was spent on Amazon Publisher Services websites, with the remaining 28% going toward other non-Amazon goods.

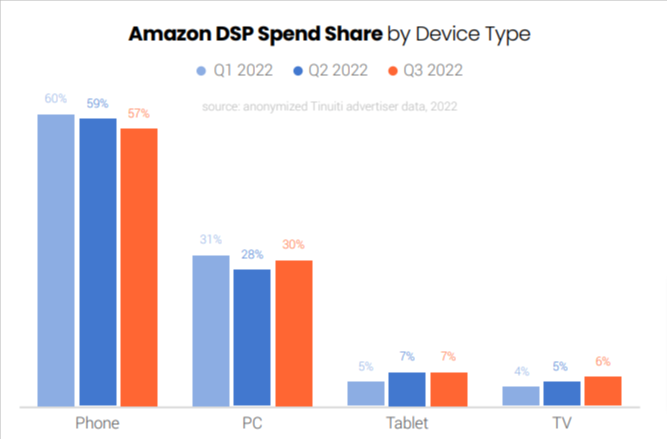

Once again, Tinuiti marketers saw a rise in the share of overall Amazon DSP expenditure attributed to television. It has risen from 4% in Q1 2022 to 5% in Q2 to 6% in the third quarter.

Television impressions have a higher CPM than other device types. Mobile devices continue to account for the majority of Amazon’s DSP investment, with 57% of spend in Q3 being attributed to phones and 7% to tablets.

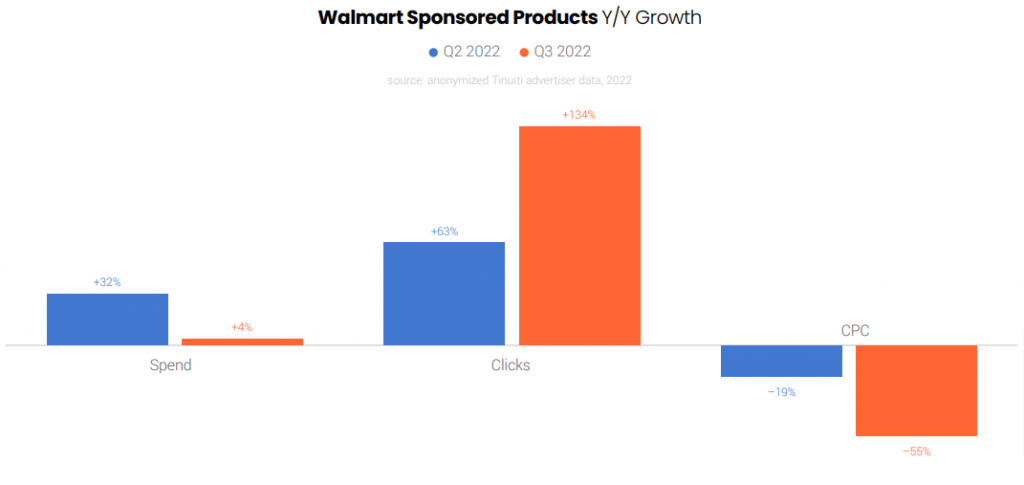

Walmart Sponsored Products: CPC Growth Fell 55% Y/Y But Recovers In September

In June 2022, Walmart moved in to switch Sponsored Products & Brands from first-price auctions. As a result, the average CPC for Sponsored Products decreased sharply in Q3, by 55% year over year, following a decline of 19% in Q2. While spending increased by 4%, clicks more than doubled (134%) in the third quarter.

Since Sponsored Products moved to second-price auctions, CPC dropped by the most in August with a 67% decrease compared to August 2021. But in September, CPC recovered to a 31% decline Y/Y.

Sponsored Brands’ percentage of all Walmart search spend decreased from 15% in the second quarter to 11% in the third. The 11% share, however, is still appreciably greater than the 7% seen in the previous Q4.

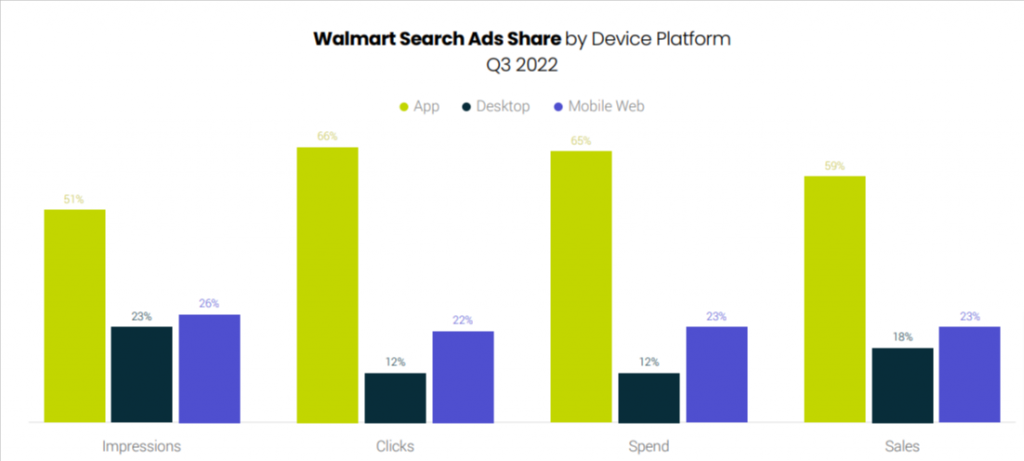

If we talk about device type, desktop sales per click continue to top other device types by 69% and mobile web sales per click by 46% in the third quarter. Desktop accounted for 12% of all Walmart Sponsored Products and Sponsored Brands clicks, but 18% of all sales.

Advertisers must be able to successfully modify bids based on the projected value of each device type if they want to maximize the effectiveness of Walmart search advertising.

Once again, to get the complete Amazon Ads Benchmark report, download it here.

Related Links

Stop the wasted ad spend. Get more conversions from the same ad budget.

Our customers save over $16 Million per year on Google and Amazon Ads.