Tinuiti is the largest independent performance marketing firm across Streaming TV and the Triopoly of Google, Facebook, and Amazon. Recently, Tinuiti shared the Amazon Ads Benchmark Report for Q2, 2022. Based on anonymized performance data from Amazon programs managed by Tinuiti, we have documented some of the study’s key findings.

The complete report can be downloaded here.

CPC For Sponsored Products & Sponsored Brands Declines

Amazon’s CPC year-over-year growth started to cool off in Q2. As Amazon’s prime day event was shifted to July from June, Sponsored Products CPC rose 8% year over year in Q2 which was the weakest growth since Q1 2021. Click growth bounced from a 6% decline in Q1 to a 5% increase in Q2.

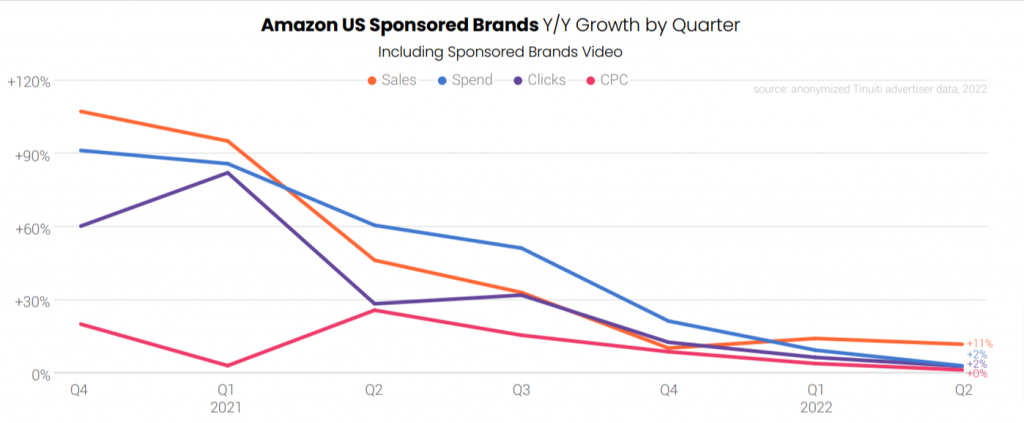

As CPC growth flattens year over year in Q2, spend growth for Amazon Sponsored Brands advertisements, including Sponsored Brands Video, dropped from 8% in the first quarter to 2% in Q2.

On the other side, sponsored display ads outpaced sponsored brands and sponsored products with an increase in spending of 59% year over year in the second quarter. In Q2, sponsored display clicks increased by 17% while CPC increased by 36%—the slowest price growth in the previous five quarters.

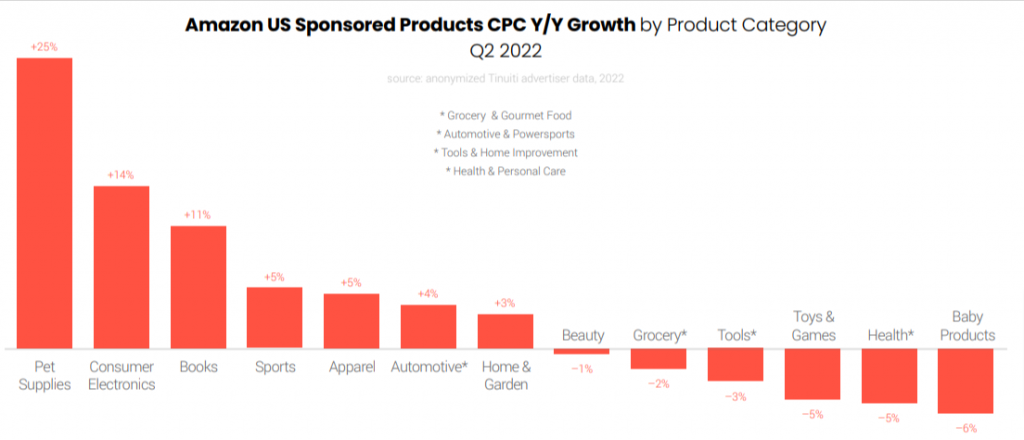

With regards to product categories, pet supplies led the product categories with a 25% gain year over year, followed by consumer electronics and literature. In Q2 2022, baby products experienced the greatest CPC reduction of any category.

Amazon DSP Spend Rose 11% In Q2, Down From 13% In Q1

As Amazon prime day moved from June to July, advertisers experienced slower spend growth. DSP spend rose 11% year over year in Q2, down from 13% in Q1, as impressions fell 3% and CPM increased 14%.

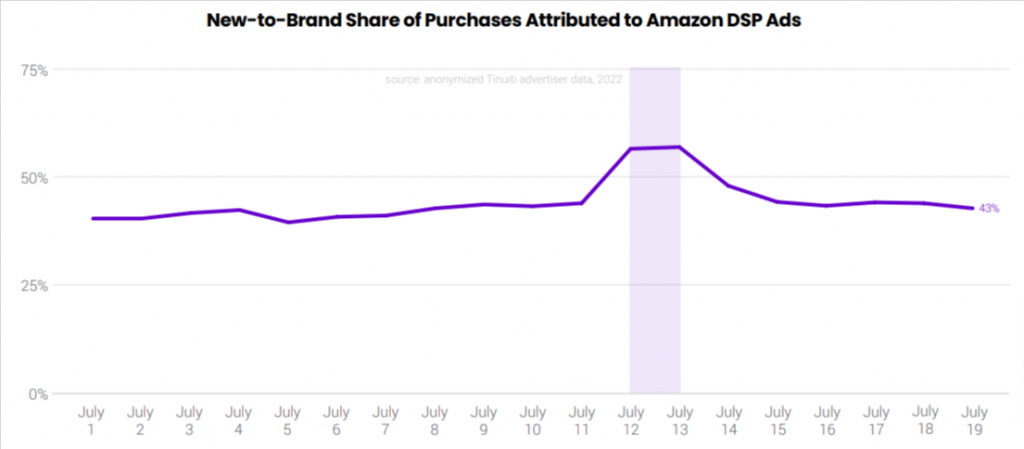

Amazon determined that 42% of all purchases made during the first eleven days of July to the DSP were made by customers who were new to the brand means consumers who hadn’t made a purchase from the advertiser in the previous 12 months.

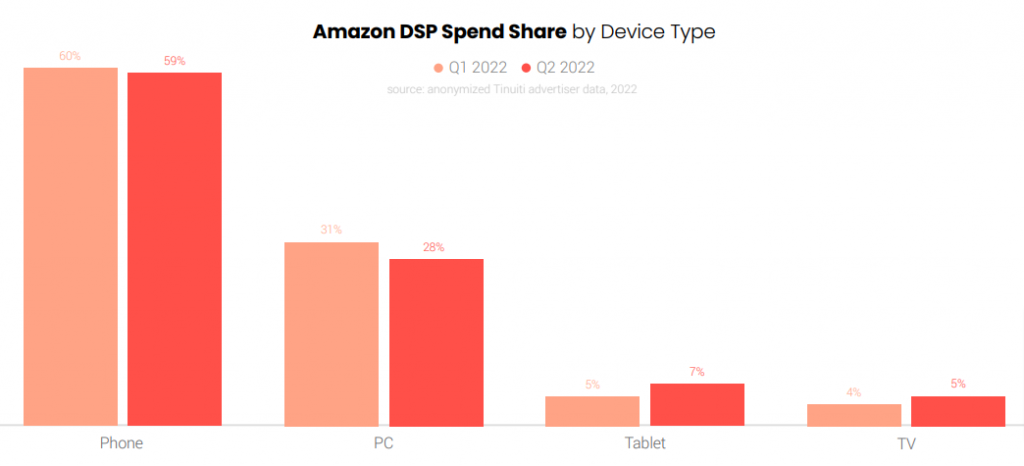

Though television accounts for a very small share of Amazon DSP spend for many advertisers, the total share across Tinuiti’s client set increased from 4% in Q1 2022 to 5% in Q2 2022. The vast majority of money is still spent on phones, which accounted for 59% of DSP investment in Q2 and were followed by PC devices at 28%. The share of tablet device spending increased from 5% in the first quarter of the year to 7% in the second.

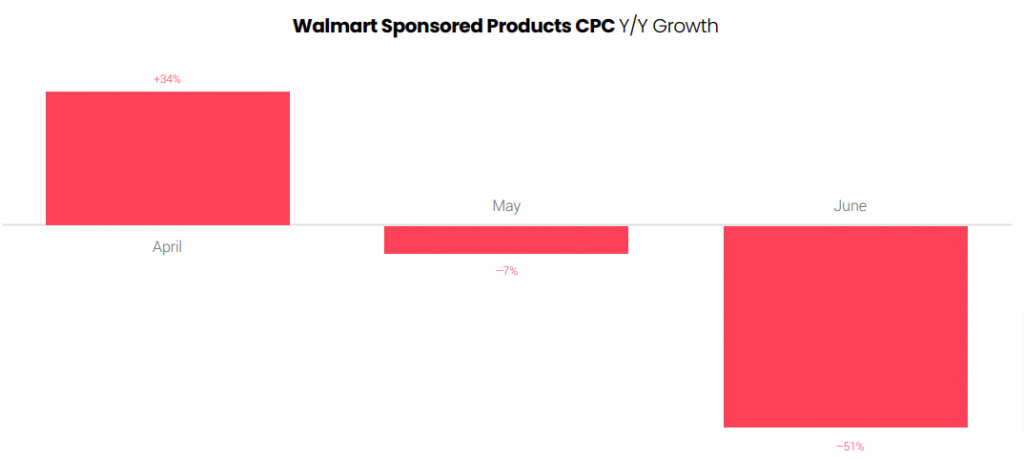

Walmart Sponsored Product’s CPC Dropped By More Than 50%

Walmart switched to a second-price auction in the first week of June, causing CPC to drop by 51% in June, compared to a 7% decline in May and a 34% increase in April. The reduction in June was not the result of advertisers changing their bid strategies, but rather a decline in the cost of ad clicks from the full amount bid by each advertiser to the minimum amount necessary to win the next auction for Sponsored Products.

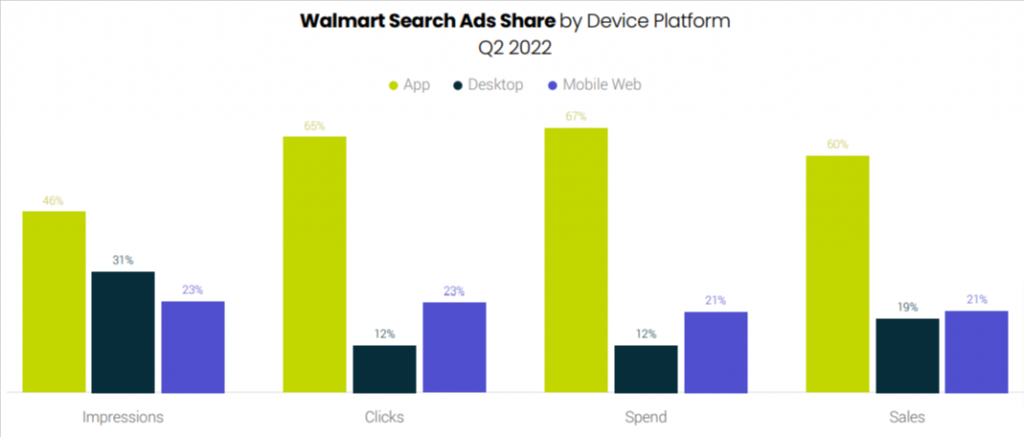

With regards to Walmart, search ad clicks for devices, the only channel that receives a higher proportion of sales than clicks on Walmart Sponsored Products and Search Brand Amplifier ads is the desktop. Only 12% of clicks were made on desktop, yet a whopping 19% of advertisers’ sales were made there. In the second quarter of the year, mobile sites and apps collectively accounted for 81% of all sales and 88% of clicks on Walmart search ads.

With the surge in app click share over the past year, desktop and mobile web click shares have also decreased, but these two device platforms are still significant because they together account for 40% of sales attributable to Walmart search ads.

Once again, to get the complete Amazon Ads Benchmark report, download it here.

Related Links

Stop the wasted ad spend. Get more conversions from the same ad budget.

Our customers save over $16 Million per year on Google and Amazon Ads.